N.Rangarajan's Model Online Promotion Test On Loan Policy Document 2010

-

In Terms of Section 20(1) of the Banking Regulation Act 1949, a Bank will not grant any loans and advances on the security of its _________ shares

The Test contains 100 question on Credit Policy Document 2010.

Each Question Carries one Mark.

No Negative Marks.

Time allowed 60 minutes.

We have fixed 70% as Pass Grade. There is no harm if you keep the New LPD 2010 (Orange Color Book) by your side and answer questions. It will improve your preparation.

Please take Quiz Password by e Mailing to rajatvk@indiatimesmail. Com your full particulars like Name,Age,Place of Work/Study,Designation/Course,Phone/Mobile No and Address

With Best Wishes fromN. Rangarajan

(139).webp)

Quiz Preview

- 2.

What is the cut off date for computing Adjusted Net Bank Credit?

-

31.03.2011

-

As on 31st March of Previous Year

-

30.09.2010

-

01.04.2010

-

On a Surprise date given by RBI

Correct Answer

A. As on 31st March of Previous YearExplanation

The cut off date for computing Adjusted Net Bank Credit is as on 31st March of the previous year. This means that the calculations for Adjusted Net Bank Credit are based on the financial data and transactions up until 31st March of the year before.Rate this question:

-

- 3.

Expand DRI

-

Departmment of Revenue Intelligence

-

Differential Rate of Interest

-

Differential Interest Rate

-

District Recovery Initiative

-

None of the above

Correct Answer

A. Differential Rate of InterestExplanation

The correct answer is Differential Rate of Interest. This refers to the difference in interest rates between two financial instruments or loans. It is commonly used in banking and finance to determine the interest rate charged on loans or the interest paid on investments. The differential rate of interest helps to determine the cost of borrowing or the return on investment, taking into account factors such as the risk associated with the loan or investment and market conditions.Rate this question:

-

- 4.

CIBIL Reports (Commercial) should be generated at the time of _________ of credit facilities.

Correct Answer

renewal

RenewalExplanation

CIBIL Reports (Commercial) should be generated at the time of renewal of credit facilities. This means that when a credit facility is up for renewal, it is important to generate CIBIL reports to assess the creditworthiness of the borrower before deciding whether to renew the credit facility or not. By reviewing the CIBIL report, lenders can evaluate the borrower's credit history, repayment behavior, and overall financial health, helping them make an informed decision about renewing the credit facility.Rate this question:

- 5.

What are the voluntary codes set set by the Bank for its commitment to customers?

-

FPCL (Fair Practices Code for Lenders)

-

Banking Codes and Standards

-

Lenders Liability Act

-

Right To Information Act

-

Ombudsman

Correct Answer

A. Banking Codes and StandardsExplanation

The correct answer is Banking Codes and Standards. These codes are voluntary guidelines set by the Bank to ensure fair and transparent practices in banking and to protect the interests of customers. They cover various aspects such as customer service, transparency in fees and charges, grievance redressal mechanisms, and responsible lending practices. By adhering to these codes, the Bank demonstrates its commitment to providing a high level of service and ethical conduct towards its customers.Rate this question:

-

- 6.

The Bank being a member of Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), will extend advances under Credit Guarantee Fund Scheme for eligible Micro and Small Enterprises upto the credit limits of Rs _________lakhs

-

50

-

75

-

100

-

125

-

200

Correct Answer

A. 100Explanation

The Bank, as a member of Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), will provide advances under the Credit Guarantee Fund Scheme for eligible Micro and Small Enterprises up to the credit limits of Rs 100 lakhs.Rate this question:

-

- 7.

How many commodities are there under selective credit control?

-

Paddy

-

Pulses

-

Edible Oil Seeds

-

Onion

-

Buffer and Unreleased Stock of Sugar Mills under Levy and Free Sale

Correct Answer

A. Buffer and Unreleased Stock of Sugar Mills under Levy and Free SaleExplanation

The answer is "Buffer and Unreleased Stock of Sugar Mills under Levy and Free Sale". This suggests that the commodities under selective credit control include the buffer and unreleased stock of sugar mills that are subject to levy and free sale regulations.Rate this question:

-

- 8.

What is the % of Credit that should go towards PS advances out of total credit for Banks in India?

-

18%

-

25%

-

40:20:40

-

40% of Adjusted Net Bank Credit or Credit Equivalent amount of OFF Balance Sheet Exposure whichever is higher

-

40%

Correct Answer

A. 40% of Adjusted Net Bank Credit or Credit Equivalent amount of OFF Balance Sheet Exposure whichever is higherExplanation

The correct answer is 40% of Adjusted Net Bank Credit or Credit Equivalent amount of OFF Balance Sheet Exposure whichever is higher. This means that banks in India should allocate 40% of their total credit towards PS advances, based on either the adjusted net bank credit or the credit equivalent amount of off-balance sheet exposure, whichever is higher. This ensures that a significant portion of the credit is directed towards priority sector advances, which are considered crucial for the development of certain sectors and segments of the economy.Rate this question:

-

- 9.

What should be the share of SC/St beneficiaries under DRI Loans granted?

-

100%

-

40%

-

33.33%

-

1%

-

5%

Correct Answer

A. 40%Explanation

The correct answer is 40% because DRI loans are specifically designed to provide financial assistance to the economically weaker sections of society, including SC/ST beneficiaries. Therefore, it is important to allocate a significant share of these loans to ensure that these communities have equal access to financial resources and opportunities for socio-economic development.Rate this question:

-

- 10.

While advancing against shares, Which sections of particular act should be strictly followed?

-

Sec 19(2) and (3) of Banking Regulation Act 1949

-

Sec 31 and 85 of NI act

-

Section 27 and 31 of RBI act

-

Sec 171 and 172 of Indian Contract Act

-

Section 41 and 42 of Banking Companies Acquisition Act

Correct Answer

A. Sec 19(2) and (3) of Banking Regulation Act 1949 -

- 11.

How long a credit sanction is valid for availment?

-

3 months

-

6 months

-

12 months

-

Till facilities are availed by Borrower

-

No Time Frame Specified

Correct Answer

A. 6 monthsExplanation

A credit sanction is the approval given by a bank or financial institution to provide credit or a loan to a borrower. The validity of a credit sanction refers to the period within which the borrower can avail of the sanctioned credit. In this case, the correct answer is 6 months, meaning that the borrower has a timeframe of 6 months to utilize the sanctioned credit before it expires.Rate this question:

-

- 12.

What will form part of Loan Policy Document 2010 subsequent to its Publication?

-

Amendments

-

Periodical Permanent Circulars

-

Periodical Permanent/Master/Transient Circulars

-

The changes in Loan Policy announced by RBI/Govt of India

-

IBA Circulars

Correct Answer

A. The changes in Loan Policy announced by RBI/Govt of IndiaExplanation

The Loan Policy Document 2010 will include the changes that are announced by the Reserve Bank of India (RBI) or the Government of India. These changes could be related to interest rates, eligibility criteria, repayment terms, or any other aspect of the loan policy. The Loan Policy Document is updated periodically to incorporate any amendments or circulars issued by the RBI or the government. It serves as a comprehensive guide for lenders and borrowers regarding the rules and regulations governing loans.Rate this question:

-

- 13.

How much DRI advances should be routed through rural and semi urban branches?

-

One third

-

Two third

-

3/4

-

4/5

-

None of the above

Correct Answer

A. Two thirdExplanation

Two thirds of DRI advances should be routed through rural and semi urban branches. This means that out of the total DRI advances, two parts out of three should be allocated to these branches. This allocation is important to ensure that the benefits of DRI (Direct Rural Infrastructure) reach the rural and semi urban areas effectively. By routing a significant portion of DRI advances through these branches, it helps in promoting development and improving infrastructure in these areas, which in turn contributes to overall socio-economic growth.Rate this question:

-

- 14.

Bank can sanction Loan against Certificate of Deposits.

-

True

-

False

Correct Answer

A. FalseExplanation

Banks cannot sanction loans against Certificate of Deposits. Certificate of Deposits are a type of time deposit where the depositor agrees to keep the funds deposited for a fixed period of time. They cannot be used as collateral for loans or be used to obtain a loan from the bank.Rate this question:

-

- 15.

Whenever outstandings are adjusted out of resources, What charges need not be recovered from Borrowers?

-

Committment Charges

-

Processing Charges

-

Upfront Fee

-

Mortgage Charges

-

Prepayment Charges

Correct Answer

A. Prepayment ChargesExplanation

Prepayment charges need not be recovered from borrowers when outstandings are adjusted out of resources. Prepayment charges are fees imposed on borrowers who pay off their loans before the agreed-upon term. In this scenario, since the outstandings are being adjusted out of resources, it implies that the borrowers are not making any prepayments. Therefore, prepayment charges are not applicable in this case.Rate this question:

-

- 16.

For prescribing lower Margin, What are the financial ratios to be complied with?

-

Current Ratio Minimum 1.20 : 1

-

DSCR 2

-

Defensive Interval Ratio 3

-

Leverage Ratio of 3:1

-

A & D above

Correct Answer

A. A & D aboveExplanation

The correct answer is A & D above. To prescribe a lower margin, the financial ratios that need to be complied with are a Current Ratio minimum of 1.20:1 and a Leverage Ratio of 3:1. The Current Ratio measures a company's ability to cover its short-term liabilities with its short-term assets, indicating its liquidity. A higher ratio indicates a better ability to meet short-term obligations. The Leverage Ratio, on the other hand, measures the proportion of debt used to finance a company's assets. A lower ratio indicates a lower level of debt and therefore lower financial risk.Rate this question:

-

- 17.

How much % of share a Bank as Pledgee,Mortgagee or Absolute Owner can hold in any company?

-

Not Exceeding 30% of Paid Up Share Capital of the Company

-

Not Exceeding 30% of Paid Up Share Capital of the Bank and reserves

-

A or B Whichever is less

-

A or B Whichever is more

-

As Investment we Bank can Hold Not Exceeding 30% of Paid Up Share Capital of the Bank and reserves and Security towards any advance Bank Can Hold Not Exceeding 30% of Paid Up Share Capital of the Company

Correct Answer

A. A or B Whichever is lessExplanation

A bank as Pledgee, Mortgagee, or Absolute Owner can hold a maximum of 30% of the paid-up share capital of the company or 30% of the paid-up share capital of the bank and reserves, whichever is less. This means that the bank's shareholding in a company cannot exceed 30% of either the company's paid-up share capital or the bank's paid-up share capital and reserves, whichever is lower.Rate this question:

-

- 18.

Credit Audit is applicable to

-

Fund Based Limits of Rs 1 Crore

-

Non Fund Based Limits of Rs 1 Crore

-

FB + NFB Limits of Rs 1 crore

-

TL Limits of Rs 2 Crores

-

Working Capital Limits of Rs 2 Crore

Correct Answer

A. FB + NFB Limits of Rs 1 croreExplanation

Credit Audit is applicable to FB + NFB Limits of Rs 1 crore. This means that both Fund Based (FB) and Non Fund Based (NFB) limits of Rs 1 crore are subject to credit audit. Credit audit is a process of reviewing and evaluating the creditworthiness and credit risk associated with a borrower or a company. It involves assessing the financial health, repayment capacity, and adherence to loan terms and conditions. By conducting credit audits, lenders can ensure that the borrowers are utilizing the credit facilities effectively and managing their finances responsibly.Rate this question:

-

- 19.

Waht is the tolerance level for not levying committment charges?

-

20%

-

25%

-

30%

-

40%

-

None of the above

Correct Answer

A. 20%Explanation

The tolerance level for not levying commitment charges is 20%. This means that if the borrower fails to fulfill their commitment by a certain percentage, which is less than or equal to 20%, the lender will not impose any charges. However, if the borrower exceeds this tolerance level, commitment charges may be imposed.Rate this question:

-

- 20.

When two valuation reports are required?

-

When the value of the Property is above Rs 1 Crore

-

When the value of the Property is above Rs 2 Crore

-

When the value of the Property is above Rs 3 Crore

-

When the value of the Property is above Rs 5 Crore

-

When the value of the Property is above Rs 1o Crore

Correct Answer

A. When the value of the Property is above Rs 5 Crore -

- 21.

The permission to allow operations in NPA account is known as

-

Survival Strategy

-

Going Concern

-

Ever Greening

-

Quick Mortality

-

Holding On Operations

Correct Answer

A. Holding On OperationsExplanation

The permission to allow operations in NPA account is known as "Holding On Operations". This term refers to the practice of allowing a non-performing asset (NPA) account to continue operations despite its inability to generate sufficient income to repay the loan. This permission is often granted by banks in order to avoid declaring the account as a bad debt and to give the borrower an opportunity to recover and repay the loan.Rate this question:

-

- 22.

A B C and Co., is enjoying working capital Cash Credit Limits against Inventory and Book Debts of Rs 100 lacs.The Limit is controlled by Drawing Power but expired..Any Excess over limit/DP will be charged overdue interest @ 2% more than the contracted rate of interest.As per sanction , the margin against stock is 25% and book debts not exceeding 120 days is 50%. The stock statement reads as follows - Total Inventory Rs 140 lacs.Creditors 30 lacs A & E is Rs 20 lacs Stock under Guarantee is Rs 30 lacs.Book Debts is Rs 200 lacs. out of Date Debts is Rs 50 lacs.The account shows outstanding of Rs 117 lacs.What is the portion on which overdue interest is to be charged?

-

No Overdue interest as Limit is within Drawing Power

-

27 Lacs

-

57 lacs

-

17 lacs

-

117 lacs

Correct Answer

A. 117 lacsExplanation

The portion on which overdue interest is to be charged is 117 lacs. This is because the total outstanding amount is 117 lacs, which exceeds the credit limit of 100 lacs. According to the given information, any excess over the limit will be charged overdue interest. Therefore, the entire outstanding amount of 117 lacs will be subject to overdue interest.Rate this question:

-

- 23.

When An MSE Borrower prefers collateral security to CGFTSE cover for loans above 10 lacs upto 100 lacs,What the Bank has to do?

-

The Bank cannot take any collateral

-

50% on CGFTSE cover basis and 50% on collateral cover

-

The Bank will record the preference of Borrower

-

Bank's acceptance of collateral advance will be recorded

-

C & D above

Correct Answer

A. C & D aboveExplanation

The correct answer is C & D above. This means that when an MSE Borrower prefers collateral security to CGFTSE cover for loans above 10 lacs up to 100 lacs, the bank will record the preference of the borrower and also record the bank's acceptance of collateral advance. This indicates that the bank will acknowledge the borrower's choice of collateral security and make a record of it for future reference and documentation purposes.Rate this question:

-

- 24.

What is the validity of Loan Policy Document 2010?

-

1 Year

-

18 Months

-

2 Years

-

Till The Next Policy is Published

-

Infinite

Correct Answer

A. 1 YearExplanation

The validity of the Loan Policy Document 2010 is 1 year. This means that the document is applicable and in effect for a period of 1 year from the date it was issued. After this time, the policy may need to be reviewed, updated, or renewed to ensure it remains current and relevant.Rate this question:

-

- 25.

What is the Margin Norm for Book Debts age upto 120 days?

-

50%

-

40%

-

30%

-

25%

-

10%

Correct Answer

A. 25%Explanation

The margin norm for book debts age up to 120 days is 25%. This means that a lender or financial institution will only provide a loan or credit facility up to 25% of the value of book debts that are aged up to 120 days. This norm helps to mitigate the risk associated with older and potentially unrecoverable debts, ensuring that the lender has a sufficient margin of safety in case of default.Rate this question:

-

- 26.

If the variation between two Valuation reports are > 10%, What is the action suggested?

-

Lower of the two should be taken

-

A Third Valuer @ The cost of Borrower should be engaged

-

Matter to be referred Institute of Valuers

-

We have another Bank Panel Valuer

-

We have to summon our Bank's Engineers from Premises Department

Correct Answer

A. A Third Valuer @ The cost of Borrower should be engagedExplanation

When the variation between two valuation reports is greater than 10%, it is suggested to engage a third valuer at the cost of the borrower. This is because the significant difference in the valuation reports indicates a lack of consensus or accuracy between the two valuers. By involving a third valuer, it helps to provide an unbiased and independent assessment, ensuring a more reliable valuation of the property. The cost of engaging the third valuer is borne by the borrower to maintain fairness in the process.Rate this question:

-

- 27.

What is the TOD limit that can be sanctioned in No Frill Accounts?

-

1000

-

2000

-

5000

-

10000

-

None of the above

Correct Answer

A. 1000Explanation

The maximum TOD (Temporary Overdraft) limit that can be sanctioned in No Frill Accounts is 1000.Rate this question:

-

- 28.

For prescribing lower Margin, What is the rating parameter to be complied with?

-

A +

-

IOB 4 and above

-

3rd rating from the top in respect of CRISIL RAM Rating

-

To Be Externally rated indicating "High Safety"

-

None of the above

Correct Answer

A. IOB 4 and aboveExplanation

The correct answer is "IOB 4 and above." This rating parameter indicates that the bank should have a rating of IOB 4 or higher. This rating is likely based on the bank's financial stability, creditworthiness, and risk management practices. By prescribing a lower margin for banks with a higher rating, it suggests that these banks are considered to have a lower risk profile and are more likely to repay their loans.Rate this question:

-

- 29.

What is the basic difference is Loan Review Mechanism and Credit Audit?

-

Off Site and On Site Audit Process

-

On Site and Off Site Audit Process

-

Internal and External Audit

-

Statutory and Non Statutory Audit

-

Revenue Audit and Compliance Audit

Correct Answer

A. Off Site and On Site Audit ProcessExplanation

The basic difference between Loan Review Mechanism and Credit Audit is the audit process location. Off Site Audit Process refers to conducting the audit remotely, without physically visiting the premises of the auditee. On the other hand, On Site Audit Process involves physically visiting the auditee's premises to conduct the audit.Rate this question:

-

- 30.

The SME units with working capital credit limits upto Rs.__________ crore will continue to be assessed as per turnover method

-

7.50

-

10 crores

-

20 crores

-

50 crores

-

100 crores

Correct Answer

A. 7.50Explanation

SME units with working capital credit limits up to Rs. 7.50 crore will continue to be assessed as per the turnover method. This means that these units will have their credit limits determined based on their annual turnover. The turnover method is commonly used for assessing the creditworthiness of small and medium-sized enterprises (SMEs) as it provides a relatively simple and efficient way to evaluate their financial health and repayment capacity. The answer of 7.50 crore indicates the threshold limit for SME units to be assessed under this method.Rate this question:

-

- 31.

The Maturity Profile of Loan Book is taken care of by

-

ALIS

-

ICRIS

-

ICRIS/ACIS

-

Data Cleaning

-

Data Warehouse (Citrix)

Correct Answer

A. ALISExplanation

ALIS is the system that takes care of the Maturity Profile of Loan Book.Rate this question:

-

- 32.

Committment Charges are applicable for FB/NFB/TL limits Rs ____ lacs and above from the Banking System.

-

100 lacs

-

50 lacs

-

150 lacs

-

75 lacs

-

200 lacs

Correct Answer

A. 50 lacsExplanation

Commitment charges are applicable for FB/NFB/TL limits Rs 50 lacs and above from the Banking System. This means that if the limit for a particular facility (FB/NFB/TL) is 50 lacs or more, the banking system will charge commitment charges.Rate this question:

-

- 33.

What is Adjusted Net Bank Credit (ANBC) ?

-

Net Bank Credit plus investments made by banks in non-SLR bonds held in HTM category

-

Net Bank Credit plus investments made by banks in non-SLR bonds held in HTM category less advances made against FCNR (B) and NRNR Deposits

-

Last Minute Window Dressing of Advances

-

Total Bank Credit Less Advances to Government

Correct Answer

A. Net Bank Credit plus investments made by banks in non-SLR bonds held in HTM categoryExplanation

Adjusted Net Bank Credit (ANBC) refers to the total bank credit available to borrowers, including both loans and investments made by banks in non-SLR (Statutory Liquidity Ratio) bonds held in the Held to Maturity (HTM) category. This measure takes into account the loans extended by banks as well as their investments in non-SLR bonds, providing a comprehensive view of the credit available in the banking system. It does not include advances made against FCNR (B) and NRNR Deposits, allowing for a more accurate assessment of the overall credit situation.Rate this question:

-

- 34.

On What type of limits pre payment penalty for pre mature closure is not applicable?

-

Term Loan Limits

-

Non Fund Based Limits

-

Working Capital Limits

-

All Fund Based and Non Fund Based Limits

-

None of the above

Correct Answer

A. Working Capital LimitsExplanation

Prepayment penalty for premature closure is not applicable on Working Capital Limits. This means that if a borrower decides to repay the loan before the agreed-upon term, they will not be charged any penalty for doing so. However, prepayment penalties may still be applicable for other types of limits such as Term Loan Limits and Non Fund Based Limits.Rate this question:

-

- 35.

Under Housing & CRE Projects other than Individual Housing Loans, to whom cost of Land can be financed and @ What Margin?

-

Public Agencies @ 40%

-

Reputed Private Builders with 50% Margin

-

Real Estate Brokers @ 60% Margin

-

Quasi Government Agencies @ 15%

-

None of the above

Correct Answer

A. Public Agencies @ 40%Explanation

Public agencies can have the cost of land financed at a margin of 40%. This means that if a public agency is involved in a housing or commercial real estate project, they can secure financing for the land they need at a margin of 40% of the total cost. This allows them to acquire the necessary land for their project while minimizing their own upfront costs. It is important to note that this financing option is specifically available for public agencies and not for other entities such as private builders, real estate brokers, or quasi-government agencies.Rate this question:

-

- 36.

Who can extend the validity of Loan Policy Document 2010?

-

Board of Directors

-

MCB (Management Committee of Board)

-

GM's Committee

-

TMC (Top Management Committee)

-

CMD

Correct Answer

A. CMDExplanation

The CMD, or Chief Managing Director, has the authority to extend the validity of the Loan Policy Document 2010. The CMD is the highest-ranking executive in the organization and holds the power to make decisions and implement policies. As such, they have the ability to extend the validity of the loan policy document, ensuring that it remains in effect for a longer period of time.Rate this question:

-

- 37.

Rating Grade IOB 9 and below warrants action under

-

Recovery Policy

-

Exit Policy

-

Multiple/Consortium Banking Policy

-

Rehabilitation and Nursing Policy

-

OTS Policy

Correct Answer

A. Exit PolicyExplanation

The correct answer is Exit Policy. This is because a rating grade of IOB 9 and below indicates that the borrower is in a weak financial position and may not be able to repay the loan. In such cases, the Exit Policy is implemented, which outlines the steps to be taken to recover the loan amount and exit the borrower from the banking system. This policy helps the bank to minimize its losses and ensure proper recovery of funds.Rate this question:

-

- 38.

What is the minimum DSCR that can be accepted now?

-

1.2

-

1.25

-

1.50

-

2

-

Above 2

Correct Answer

A. 1.25Explanation

The minimum Debt Service Coverage Ratio (DSCR) that can be accepted now is 1.25. DSCR is a financial metric used by lenders to assess the ability of a borrower to repay their debt obligations. A DSCR of 1.25 means that the borrower's operating income is 1.25 times higher than their debt payments, indicating a stronger ability to meet their financial obligations.Rate this question:

-

- 39.

If Margin is fixed on Working Capital gap,what is the method of finance called?

-

Turnover Method

-

Cash Budget Method

-

Traditional Method I

-

MPBF II

-

Assessment III

Correct Answer

A. Traditional Method IExplanation

The correct answer is Traditional Method I. In this method of finance, the margin is fixed on the working capital gap. This means that a certain percentage of the working capital gap is considered as margin and the remaining amount is financed by external sources. This method is commonly used to determine the amount of funds required to meet the working capital needs of a business. It helps in assessing the adequacy of funds and ensures that the business has enough liquidity to operate smoothly.Rate this question:

-

- 40.

How credit is controlled under Selective Credit Control Commodities?

-

By Margin

-

By Pricing

-

By Collateral Cover

-

By Repayment

-

All the above

Correct Answer

A. By MarginExplanation

Credit control under Selective Credit Control Commodities is controlled by margin. Margin refers to the difference between the market value of the commodity and the value of the loan provided. By setting a margin requirement, the authorities can control the amount of credit extended for the purchase of select commodities. This helps in preventing excessive speculation and ensuring that credit is provided in a controlled manner, reducing the risk of financial instability.Rate this question:

-

Quiz Review Timeline (Updated): Dec 11, 2023 +

Our quizzes are rigorously reviewed, monitored and continuously updated by our expert board to maintain accuracy, relevance, and timeliness.

-

Current Version

-

Dec 11, 2023Quiz Edited by

ProProfs Editorial Team -

Feb 26, 2011Quiz Created by

Rajatvk

Fixing Your Credit Math With A Quiz

Welcome to the "Fixing Your Credit Math With A Quiz" challenge! Whether you're a financial whiz or just starting your credit journey, this quiz is designed to...

Questions:

10 |

Attempts:

322 |

Last updated:

Mar 08, 2024

|

Debit Cards Vs Credit Cards.

This quiz titled 'Debit Cards vs Credit Cards' explores key differences between debit and credit card usage, focusing on implications for personal finance. It assesses...

Questions:

5 |

Attempts:

2986 |

Last updated:

Jan 18, 2023

|

Quiz 2 2017: Credit Cards, Credit Reports, Credit Scores And Paying For College

This quiz covers essential aspects of credit management, including the use of credit cards, factors affecting credit scores, understanding credit reports, and the implications of...

Questions:

17 |

Attempts:

273 |

Last updated:

Mar 17, 2023

|

CCE Practice Test #2

Certified Credit Executive is a professional designation issued by the National Association of Credit Management that validates a person’s capability to manage credit....

Questions:

100 |

Attempts:

736 |

Last updated:

Mar 21, 2023

|

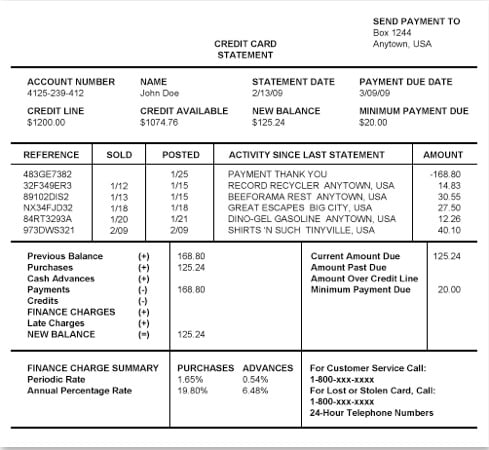

Sample Credit Card Statement

You will need to use the following Sample Credit Card Statement to answer the following questions:

Questions:

12 |

Attempts:

736 |

Last updated:

Mar 22, 2023

|

Quiz 2 2015: Credit Cards, Credit Reports, Credit Scores And Paying For College

This quiz covers essential aspects of credit management, including best practices for credit card usage, key factors affecting credit scores, understanding credit reports, and the...

Questions:

15 |

Attempts:

781 |

Last updated:

Mar 21, 2023

|

Back to top

Back to top